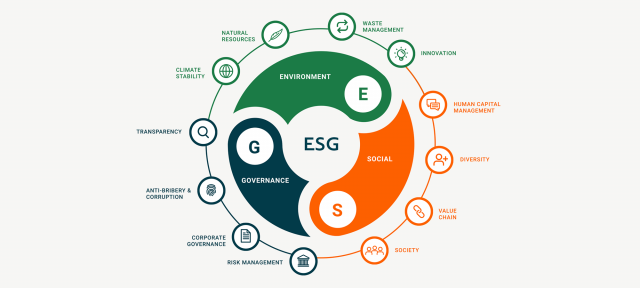

ESG, particularly the environmental aspect, has been a subject of extensive discussion, gaining significant attention during the Covid-19 pandemic. The crisis accelerated the global drive for companies to embrace ESG, making it more than just a phenomenon confined to the affluent world. The Biden administration's recent announcements on the American Jobs Plan and climate change action underscore the need for all investors to consider ESG and navigate its intricacies. Emerging markets, including India, are actively enhancing their ESG disclosures, transforming ESG factors from a "good to have" to a "must have" for every corporation. Companies now recognize their broader role, focusing on the triple bottom line of Profit, People, and Planet. In this article, we will scrutinize India, one of the vital emerging markets, through an environmental, social, and governance lens.

Companies pursue sustainability because it has a tangible impact. Establishing sustainable practices for resource utilization (energy, water, and waste in relation to revenue) indicates superior financial performance across sectors. Remarkable success is observed in companies that prioritize their ESG parameters, experiencing not only higher growth but also stronger earnings growth and dividends.

The Emerging Markets Landscape - India

ESG awareness and available information have primarily focused on the West and developed markets, with Europe and South America taking the lead. However, buy-in for ESG investing in the Asia Pacific, especially in emerging economies, has been gradual. A CFA research in 2019 identified a limited understanding of ESG issues, a lack of company culture around ESG integration, and insufficient client demand as the main barriers to equity and fixed-income integration in India.

While this might have been the case back then, the Covid-19 pandemic and renewed focus on ESG equity funds have led to significant improvements in company culture regarding ESG and increased government emphasis on transparent public reporting of these indicators. Contrary to the assumption that India lags in environmental, social, and governance aspects, disclosure scores have significantly improved over the years.

India's ESG Disclosure Status in Companies

Given this context, it is not surprising that India surpasses global averages in certain sectors while lagging in others when it comes to ESG disclosures. The cement and IT industries perform well in ESG scoring, with India demonstrating strength in social disclosures but falling behind in environmental and governance aspects. However, we acknowledge that most disclosure scores are still a work in progress for Indian firms, particularly for mid to small-cap companies. Nevertheless, there has been a notable shift in firms' disclosure practices compared to a few years ago, with India striving to enhance transparency in this domain. International organizations' involvement, such as Climate Action 100+ and The Asia Investor Group on Climate Change (AIGCC), along with investors' own engagement efforts, could further augment disclosures and ESG improvements.

Adoption of Responsible Business Practices: Journey from BRR to BRSR

In 2012, SEBI took a step towards promoting corporate responsibility by mandating Business Responsibility Reports (BRR) alongside annual reports for the top 100 National Stock Exchange of India (NSE) listed companies. The format included disclosing policies related to Corporate Governance, Anti-Corruption, Money Laundering, and Board Independence, leading to visible changes in reporting from 2014 onwards. Companies began disclosing not only their policies but also auditing and training details related to governance and anti-corruption. Subsequently, in December 2019, SEBI expanded the BRR filing requirement to the top 1000 companies by market capitalization.

BRSR - Emphasis on Governance

In March 2021, SEBI introduced greater transparency through Business Responsibility and Sustainability Reporting (BRSR). The new format takes a granular approach, covering Environmental (GHG Emissions, Carbon Neutral, Deforestation, etc.), Social (Employee welfare, Consumer protection, Privacy, Data Security, etc.), and Governance (Board, Pay, Audit, Ownership) factors. Initially applicable on a voluntary basis for the financial year 2021-22 for the top 1000 listed entities, it became mandatory from the financial year 2022-23.

These positive changes are expected to be visible in the coming years, enabling Indian companies to align more effectively with international standards such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB).

The Way Forward

Climate Change: An Imperative Topic

The 26th UN Climate Change Conference of the Parties (COP26) was held in November 2021, building momentum worldwide towards achieving net-zero targets. Since then, the world has witnessed a myriad of regulatory, legislative, industry, and corporate initiatives to combat climate change, with climate and renewable energy taking center stage globally. Europe, in particular, is leading with ambitious policies under the EU climate action and the European Green Deal, aiming to become the world's first climate-neutral continent by 2050.

While awareness of climate change risks has grown in Asia, only a few countries have made significant commitments, submitting renewed Nationally Determined Contributions (NDCs) under the Paris Agreement. It is crucial for more Asian nations to recognize the importance of climate risk and proactively drive change. Recent pledges of net-zero targets by China, Japan, and South Korea, along with India's ambitious renewable energy targets, reflect positive steps. Realistic progress toward wind and solar capacity targets by China, India, and Vietnam has been identified by the Asia Investor Group on Climate Change (AIGCC).

Aiming for carbon neutrality and charting a path to decarbonization is a paramount consideration for countries and companies alike.

Driving Climate Awareness from the Bottom Up

For asset managers, integrating climate resilience into investments fosters sustainability and safeguards development gains. Hence, investors must engage in stewardship and collaborative activities with companies. Working groups like UNPRI, Climate Action 100+, and Net Zero Asset Owner Alliance offer platforms for asset owners and managers to drive awareness of climate-related topics and the significance of climate action. Collectively, these efforts will influence the investing landscape and secure a sustainable future for all.

Adjusting to Local Nuances for Sustainability

Benchmarking India against international standards may not be appropriate, necessitating adjustments to suit local nuances. While achieving a complete phase-out of fossil fuels in the short term, akin to developed countries, might be challenging for India, a more sustainable approach to lower carbon emissions can be encouraged. SEBI's BRSR is a positive step forward, although it will take time to implement across all companies. Most Indian companies have been following sustainable practices but have not documented these actions until recently. Moreover, Indian companies are aligning their strategies with Sustainable Development Goals (SDGs).

In conclusion, sustainability is undoubtedly a long journey, but India is steadily catching up with the rest in terms of ESG investing and ESG mutual fund.

Disclaimer: Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing.

Comments

Post a Comment